Back

24 Jul 2020

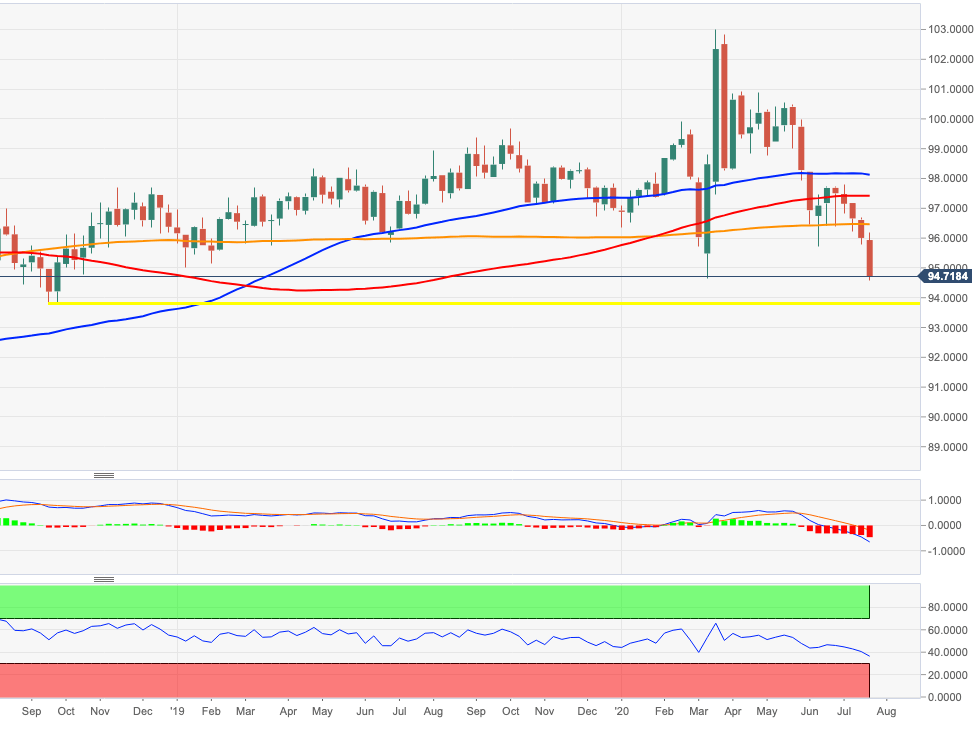

US Dollar Index Price Analysis: Rising odds for a move lower to 94.20

- DXY clinched fresh lows in levels last traded in October 2018 near 94.60.

- A deeper pullback exposes the Fibo level at 94.20 ahead of 93.81.

The sell-off in DXY has reached new 4-month lows in the 94.60/55 band earlier on Friday, leaving the prospects of further losses intact in the near-term.

In fact, further downside is increasingly likely in the current bearish context, allowing for a probable move and test of the Fibo level (of the 2017-2018 drop) at 94.20. Further south emerges the September 2018 low at 93.81.

The negative outlook on the dollar is expected to remain unaltered while below the 200-day SMA, today at 98.13.

DXY weekly chart